Installment Sale Of Intangible Property

Section 1250 Property; Installment Sales. Dispositions of Intangible Property. A corporation cannot deduct a loss on the sale of a section 197 intangible if.

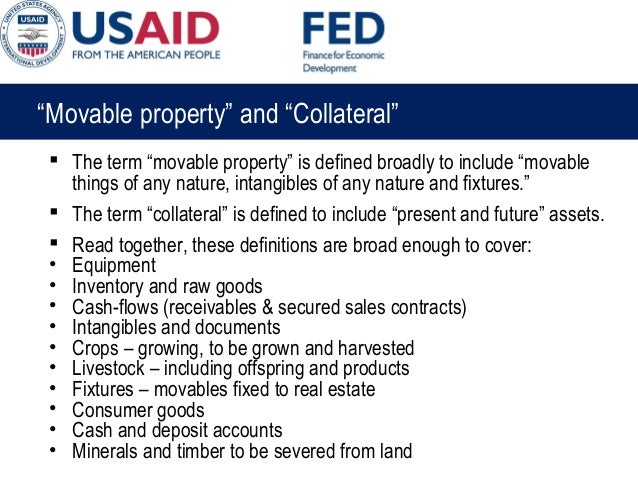

Intangible personal property is property that has no intrinsic value but is merely representative or evidence of value. Common examples include securities (both public and private), copyrights, royalties, patents, personal service contracts, installment obligations, life insurance and annuity contracts, and partnership interests. This memorandum examines the most common types and forms of intangible personal property that are considered for contribution to charity, and the special rules that apply to charitable deductions for income, gift, and estate tax purposes.

Introduction Intangible personal property is property that has no intrinsic value but is merely representative or evidence of value.Described another way, intangible personal property is personal property (other than real property) whose value stems from its intangible elements rather than from its specific tangible (physical) elements. Although the Code does not provide a concise definition of intangible personal property, it does provide several examples. For example, section 936(h)(3)(B) defines intangible property to mean any-. copyright, literary, musical, or artistic composition;. patent, invention, formula, process, design, pattern, or know-how;. trademark, trade name, or brand name;. franchise, license, or contract;.

method, program, system, procedure, campaign, survey, study, forecast, estimate, customer list, or technical data; or. any similar item, which has substantial value independent of the services of any individual.

With respect to charitable gift planning, the most common types of intangible personal property that gift planners encounter include securities (both public and private), copyrights, royalties, patents, personal service contracts, installment obligations, life insurance and annuity contracts, and partnership interests. Intangible property is also frequently 'bundled' with tangible or real property.

Examples include a work of art and its copyright, or mineral rights and the real property from which the minerals are derived. The deductibility of such contributions depends on a variety of factors that frequently depend on whether the interests are given in combination or separately. The balance of this memorandum examines the most common types and forms of intangible personal property that are considered for contribution to charity, and the special rules that apply to charitable deductions for income, gift, and estate tax purposes. Due to their scope and complexity, however, publicly traded securities and privately-held business interests (which includes corporations, partnerships, and limited liability companies) are the subjects of separate memoranda. General Tax Deduction Rules It is important to note that contributions of intangible personal property are not subject to the same rules as apply to gifts of tangible personal property. Specifically, the related-use and future interest rules do not apply to gifts of intangible assets. As will be discussed, however, the partial interest rule and Section 170 reduction rules (applicable to contributions of ordinary income property) frequently come into play with respect to transfers of intangible assets.

For gift and estate tax deduction purposes, intangible personal property is subject to the same general rules as apply to tangible personal property and real property. Specific rules and exceptions are discussed in connection with each type of intangible asset.

(i) If under local law A's will is treated as fully transferring both the work of art and the copyright interest to X, then paragraph (e)(1)(i) of this section does not apply to disallow a deduction under section 2055 for the value of the work of art and the copyright interest. (ii) If under local law A's will is treated as transferring only the work of art to X, and the copyright interest is treated as part of the residue of the estate, no deduction is allowable under section 2055 to A's estate for the value of the work of art because the transfer of the work of art is not a qualified contribution and paragraph (e)(1)(i) of this section applies to disallow the deduction. B, a collector of art, purchased a work of art from an artist who retained the copyright interest.

B died in 1983. Under the terms of B's will the work of art is given to Y charity. Since B did not own the copyright interest, paragraph (e)(1)(i) of this section does not apply to disallow a deduction under section 2055 for the value of the work of art, regardless of whether or not the contribution is a qualified contribution under paragraph (e)(1)(ii)(c) of this section.

Patents The patent laws of Title 35 of the United States Code protects the intellectual property rights of those who invent or discover any new and useful process, machine, manufacture, or composition of matter, or any new and useful improvement thereof. Patents are issued in the name of the United States of America, under the seal of the Patent and Trademark Office. They grant to the patentee, his or her heirs, or assigns the right to exclude others from making, using, offering for sale, or selling the property subject to the patent throughout the United States, or importing the property into the United States. Term of Patent Patents are granted for a term beginning on the date on which the patent issues and ending 20 years from the date on which the application for the patent was filed in the United States or, if the application contains a specific reference to an earlier filed application or applications under section 120, 121, or 365(c) of Title 35, from the date on which the earliest such application was filed. If the issue of an original patent is delayed for various administrative reasons, the term of the patent shall be extended for the period of delay, but in no case more than five years. Transfer of Ownership of Patent Section 261 of U.S.C. Title 35 provides that applications for patent, patents, or any interest therein, are assignable in law by an instrument in writing.

The applicant, patentee, or his assigns or legal representatives may in like manner grant and convey an exclusive right under his application for patent, or patents, to the whole or any specified part of the United States. Section 83(b) Election As an alternative to realizing income on exercise, the employee can make an election to recognize compensation income when the option is granted. In such case, the amount recognized is equal to the difference between the strike price of the option and the fair market value of the stock on the date of grant.

When the employee subsequently exercises the option, no income is realized on the subsequent exercise of the option; however, gain is realized when the optionee subsequently sells the stock. The optionee's basis in the acquired shares is the amount paid for the shares increased by the amount included in gross income under section 83(b) at the time of grant. In other words, the basis is the fair market value of the stock on the date of grant. According to the Internal Revenue Service, the 83(b) election is not available with respect to a stock option, unless the option is actively traded on an established market. This is a difficult pre-condition to the 83(b) election. If the section 83(b) election is available, it must be filed no later than 30 days following the grant of the option with the IRS office with which the person rendering the services files his or her income tax return.

In addition, a copy of the election must be included with that employee's income tax return for the taxable year in which the property is transferred. In addition, state filing requirements may apply. Planning Tip: Assuming it is possible to make an 83(b) election, taxpayers may wish to consider doing so even if it results in some current income tax. By making the election, any gains from the subsequent sale of optioned shares are considered capital gains rather than compensation income. As a result, provided the shares are held for at least one year after exercise, gains from sale of are taxable at favorable capital gains rates without mandatory withholdings. And as will be discussed further, the conversion of stock into a capital asset via the 83(b) election sets the stage for charitable applications. Inter Vivos Charitable Transfers of Nonstatutory Stock Options The regulations provide that if the option is sold or otherwise disposed of in an arm's length transaction, sections 83(a) and 83(b) apply to the transfer of money or other property received in the same manner as sections 83(a) and 83(b) would have applied to the transfer of property pursuant to an exercise of the option.

An arm's length inter vivos transfer of an unexercised, nonqualified stock option to a charitable organization or charitable trust will result in ordinary income to the employee in an amount equal to the spread between the exercise (strike) price and the fair market value of the stock on the date of transfer. Furthermore, because the employee has no cost basis in the option and all gain is considered ordinary income, no income tax charitable deduction is available for IRC §170(b)(1)(E). Accordingly, the employee will have phantom ordinary income with no offsetting charitable deduction. Retained Control Delays Income Recognition Ltr. 9737016 offers a creative alternative to the recognition of compensation upon transfer of a nonqualified option to charity. In that ruling an employee proposed to transfer nonqualified stock options through an intermediary to a qualified charitable organization.

The employee would, however, retain during his lifetime a power that would require the charitable donee to obtain his permission to exercise the options. If he died, the charity could immediately exercise the options without regard to any specified exercise dates. The Service ruled that because the employee retained a power restricting the exercise of the option, the charitable gift was not complete until the power lapsed. Therefore, the employee would not recognize compensation income or receive a charitable deduction until the options were exercised.

The ruling also confirmed that compensation income recognized in connection with the exercise of a nonqualified stock option is subject to withholdings and that the charitable donee would be required to pay the required withholding tax to the company. Exercise Followed by and Contribution of Stock without Section 83(b) Election As an alternative to transferring an unexercised option, the employee can exercise the option and contribute optioned shares. However, the employee must provide the exercise price and will have ordinary income to the extent the fair market value of the stock exceeds the exercise price.

The optionee's basis in the optioned shares is the fair market value of the shares on the date of exercise. The exercise date establishes the holding period of stock in the hands of the optionee for capital gains purposes. Therefore, if exercised shares are transferred to charity within one year of exercise, the donor's income tax charitable deduction will be limited to the lesser of fair market value and basis. If the donor transfers exercised shares held at least one year following exercise, the income tax charitable deduction is based on the fair market value of the shares (provide the stock is publicly traded or, if not, is transferred to a public charity). Although the donor may be able to claim a larger charitable deduction (provides the shares have appreciated), the donor will not be able to claim the charitable deduction in the same year he or she realizes income from the exercise of the option.

Exercise Followed by and Contribution of Stock with 83(b) Election As mentioned previously, an employee can avoid recognition of compensation income upon exercise of a nonqualified option by electing to take the 'in the money' portion of the option into income when the option is granted. More importantly, the election converts potential ordinary income into potential capital gains that can be eliminated or delayed through a carefully designed charitable gift. Testamentary Charitable Transfers of Nonstatutory Employee Stock Options As an alternative to lifetime transfers, nonstatutory options may, subject to plan provisions, be transferred to charity on a testamentary basis.

In this way, the optionee will avoid recognition of compensation on transfer and exercise by the donee. 1.421-6(d)(5) provides that if an employee dies before realizing compensation from a nonstatutory employee stock option, compensation income is realized by the person who transfers or exercises the option, or the person who receives property subject to a restriction which has a significant effect on its value. For example, this rule is applicable. Effect of Disqualifying Dispositions Statutory options are subject to holding period requirements relating to disposition of exercised shares. In the case of incentive stock or employee stock purchase plan, an optionee avoids recognition of compensation provided the stock is disposed of after the latter of -. two years from the date of grant, and.

one year from the date of exercise. IRC 424(c) and the regulations thereunder define the term 'disposition' to include a sale, exchange, gift, or transfer of legal title, but does not include -. a transfer from a decedent to an estate or a transfer by bequest or inheritance.

an exchange to which section 354, 355, 356, or 1036 (or so much of section 1031 as relates to section 1036 applies. a mere pledge or hypothecation (however, a disposition of the stock pursuant to a pledge or hypothecation is a disposition by the individual, even though the making of the pledge or hypothecation is not such a disposition. the acquisition of a share of stock in the name of the employee and another jointly with the right of survivorship or a subsequent transfer of a share of stock into such joint ownership (however, a termination of such joint tenancy, except to the extent such employee acquires ownership of such stock, shall be treated as a disposition by the employee occurring at the time such joint tenancy is terminated). certain transfers of statutory option stock pursuant to the exercise of incentive stock options. transfers between spouses or incident to divorce. Inter Vivos Charitable Transfers of Statutory Employee Stock Options With respect to charitable transfers, the disposition rules of section 424 provide that an inter vivos transfer of an unexercised statutory option to a charitable organization or charitable trust will trigger phantom compensation income to the optionee.

Accordingly, a lifetime transfer of exercised shares to a charitable organization or charitable trust prior to the expiration of the applicable holding period would be deemed a disqualifying disposition within the meaning of IRC §421(b). One taxpayer proposed to exercise an incentive stock option that had been held for longer than two years, then transfer the exercised shares into a charitable remainder trust within one year of exercise. The Service ruled that such a transfer causes the taxpayer to recognize compensation in the amount equal to the difference between the exercise price and the fair market value of the stock on the date of exercise. The Service further stated that if the taxpayer transfers the stock after the one-year holding period, no compensation is recognized. Planning Opportunity: Holders of qualified options may exercise their options one of several ways (with borrowed funds, a portion of the optioned stock, or cash), wait the mandatory one year holding period, and transfer the a portion of the exercised shares to a charitable gift vehicle such as a charitable remainder trust, pooled income fund, or charitable gift annuity.

Testamentary Charitable Transfers of Statutory Employee Stock Options As mentioned earlier, a statutory option is not transferable by the employee other than by will or by laws of descent and distribution. The regulations provide further that if the option (or the plan under which the option was granted) contains a provision permitting the individual to whom the option was granted to designate the person who may exercise the option after his death, neither such provision, nor a designation pursuant to such provision, disqualifies the option as a statutory option. The term 'person' includes an individual, trust or estate, partnership, association, company, or corporation. Accordingly, a charitable organization or trust can, providing the plan so permits, receive a testamentary transfer of an unexercised statutory option.

IRS Rules on Option with Unencumbered Property In Ltr. 9240017, the IRS concluded that, under facts similar to those presented above, the trustee's contractual right to acquire a fee interest in the property for an amount below the fair market value of the property is an asset of the trust for purposes of meeting the requirements of IRC §664(d)(2).

In addition, the trustee's contractual right to acquire a fee interest in real property with substantial value ($2,000,000) for an amount substantially lower ($100,000) has substantial fair market value. This substantial fair market value must be included each year in determining the net fair market value of the trust's assets and the resulting unitrust amount payable to the income recipient. Regarding the availability and sequencing of the trustor's income tax charitable deduction, the IRS's opinion was disappointing, but logical.

82-197 holds that an individual who grants an option on real property to a charitable organization is allowed a charitable deduction in the year in which the charitable organization exercises the option. The amount of the deduction is equal to the excess of the fair market value of the property on the date the option is exercised over the exercise price.

The IRS concluded the trustor is not entitled to a deduction for the remainder interest, either when the purported option is granted to the trust or when the trustee sells it. The trustor will, however, be entitled to a deduction for the remainder interest if the trustee or another charitable organization (including the charitable remainderman) exercises the option. The deduction is based on the spread between the fair market value and the exercise price ($1,900,000). IRS Rescinds Ltr. 9240017 One month after receiving a favorable ruling regarding the use of an option with unencumbered real property, the same taxpayer requested a new ruling on the use of the same technique with debt-encumbered real property.

This triggered an unanticipated result: the Service responded by immediately by issuing Ltr. 9417005 in which it rescinded Ltr. 9240017 stating only that it was reconsidering the issues raised in that ruling.

IRS Rules on Use of Options for Unencumbered and Encumbered Assets In September of 1994, the Service responded to the second ruling request by issuing Ltr. 9501004 in which it answered two questions: Is a charitable remainder trust that receives as its sole funding asset an assignable call option a qualified charitable remainder trust? And will the trustor or such a trust be treated as the owner of the trust, thereby causing the gain realized on the sale of the option to be realized by the taxpayer?

With respect to the first issue, the Service first stated, 'To qualify as a charitable remainder trust within the meaning of section 664 of the Code and the regulations thereunder, a trust must be one with respect to which a deduction is allowable under one of the specified sections-section 170, 2055, 2106, or 2522. Further, the trust must be a charitable remainder trust in every respect and must meet the definition of and function exclusively as a charitable remainder trust from its creation.

The requirements of being a charitable remainder trust in every respect and functioning exclusively as a charitable remainder trust from its creation cannot be met unless each transfer to the trust during its life qualifies for a charitable deduction under one of the applicable sections (IRC §§170, 2055, 2106, or 2522).' This being an inter vivos trust, the Service then focused its attention on the qualification for income tax deduction under section 170 and qualification for gift tax deduction under section 2522.

With respect to qualification for an income tax deduction, the IRS concluded, 'The transfer to a charitable organization of an option by the option writer is similar to the transfer of a note or pledge by the maker. In the noted situation there is a promise to pay money at a future date. In the pledge situation there is a promise to pay money or transfer other property, or to do both, at a future date. And in the option situation there is a promise to sell property at a future date. Although the promise may be enforceable, a promise to pay money or to sell property in the future is not itself a 'payment' for purposes of deducting a contribution under section 170 of the Code.

Thus, the grant of the option to the charitable organization in this case is not a contribution for which a deduction is allowable under section 170.' With respect to the availability of the gift tax charitable deduction under section 2522, the IRS cited Rev. The ruling concludes that a transfer of an option to purchase real property for a specified period is a completed gift under section 2511 of the Code on the date the option is transferred, if, under state law, the option is binding and enforceable on the date of the transfer. In the instant case, under local law, the purported option was not binding on the taxpayer when it was granted. Accordingly, the proposed transfer of the purported option to the trust was not a completed gift on the date of transfer under section 25.2511-2(b) of the regulations because the taxpayer would not have made a binding offer on that date. In absence of income and gift tax charitable deductions, the Service ruled the trust is not a qualified charitable remainder trust. With respect to the second issue (i.e., whether the grantor would be treated as the owner of the trust and, accordingly, be taxable on the gain from the sale of the option), the IRS's conclusion was obvious.

If the trust is not a qualified charitable remainder trust, it must be a grantor trust the income from which, including gain from the sale of trust assets, is taxable to the grantor. Property Subject to Right of First Refusal Can a donor transfer property in which a first right is retained by the donor or another person to purchase the property in the event the charitable donee decides to sell it? Are transfers of property subject to rights of first refusal deductible for income, gift, and estate tax purposes? 8641017, an individual proposed to contribute real property to a charitable organization on the condition that, if the organization ever intends to sell the property to other than a charitable organization during the twenty year period following the gift, the donor can purchase the property at the price offered by a bona fide third-party. In addition, the donor placed other restrictions on the property related to its use.

76-151, in which a corporate donor reserved the right to purchase the land and building at its fair market value if the charitable organization ceased to use the property and decided to dispose of it, the Service ruled that the taxpayer was entitled to a charitable contribution deduction, subject to the limitations of section 170(b)(2) of the Code for the land and building transferred to the charitable organization. In addition, the Service cited Rev. 85-99 in which it ruled the amount of the donor's charitable contribution deduction is the fair market value of the property at the time of the contribution determined in the light of the restriction placed by the donor on the use of the property.

Caution: and the other rulings referenced therein contemplate an outright gift to charity. Planners should note that if assets are transferred to a private non-operating foundation or a split-interest gift vehicle to which the private foundation excise tax rules apply (i.e., a charitable remainder trust or charitable lead trust), a repurchase by the donor or other disqualified person of a contributed asset would constitute a prohibited act of self-dealing. The previous rulings deal with transfers of real property. Do the same rules apply to transfers of securities? 80-83, a transfer of stock of a publicly held corporation subject to a first right of refusal by the corporation to a charitable remainder trust which named the trustor as trustee qualified for a gift tax charitable deduction under IRC 2522.

The right required any shareholder desiring to sell stock to first offer the shares to the corporation at the same price and terms as offered to any other buyer. The ruling holds, 'The value of the charitable beneficial interest is presently ascertainable as that term is used in section 25.2522(c)-3 of the regulations.

Accordingly, the charitable deduction is allowable for gift tax purposes, with respect to the remainder interest.' Query: What if the corporation is a disqualified person? Normally, a transfer of stock to a charitable remainder trust or charitable lead trust of more than 35 percent of the voting stock of the corporation followed by a corporate redemption is a prohibited act of self-dealing. However, IRC 4941(d)(2)(F) provides that such a transaction will be exempt from the self-dealing rules 'if all of the securities of the same class as that held by the foundation are subject to the same terms and such terms provide receipt by the foundation of no less than fair market value.'

Property 5 (1951). Texas Instruments, Inc. (CA-5, 1977), 551 F.2d 559, 39 AFTR 2d 77-1383.

Title 17, Sec. Title 17, Sec. Title 17, Sec. Title 17, Sec. 94-553, Title I, Sec. 19, 1976, 90 Stat.

Title 17, Sec. Title 17, Sec. Title 17, Sec. Title 17, Sec. Title 17, Sec. Griffin v Comm., 33 TC 616 (1959).

IRC §1239(e). IRC §170(e)(1)(A).

IRC §170(f)(3)(A), specifically, a charitable remainder trust, charitable lead trust, pooled income fund, remainder interest in personal residence or farm, undivided interest in every right owned by donor, or qualified conservation easement. §1.170A-7(b)(1)(i).

IRC §2055(e)(4). IRC §2055(e)(4)(B). §1.170A-4(b)(3) for rules used to determine if the use of property by a charitable organization is related to such purpose or function. GCM 38083. Moore v. Comm., 27 T.C.M. 536(1968); See also Lucas v.

Earl, 281 U.S. 11, 8 AFTR 10287 (1930).

IRC §614;. See also The J. Mabee Foundation, Inc., Plaintiff-Appellant v. United States of America, Defendant-Appellee (CA-10), U.

Court of Appeals, 10th Circuit, No. 75-1231 (74-C-135), 533 F2d 521, 4/12/76, Affirming District Court decision, 75-1 USTC 9266, 389 F. 673. IRC §1254. Reg. §1.636-3(a). IRC §636(a).

IRC §514. Francine Schuster v.

20396-82, 84 TC -, No. 51, 84 TC 764, (Filed April 29, 1985); Lucas v. Earl, 281 U.S.

111 (1930); Helvering v. Horst, 311 U.S. 112 (1940), 1940-2 C.B. 206; Helvering v. Eubank, 311 U.S. 122 (1940), 1940-2 C.B. 77-290, 1977-2 C.B.

26; Allen Leavell v. Comm., (January 30, 1995) Doc. 29996-91., 104 TC 140; Ltr. 8624007.; Lussy v. Commissioner, (August 16, 1995) T.C. 1995-393; Levine, et ux v.

Comm., (August 24, 1987) T.C. 1987-413; Boynton v. Comm., (December 19, 1985) T.C. 1985-619.;, as modified by. Charles L. And Marilyn F. Commissioner, Doc.

10863-77, 37 TCM 1817, TC Memo. 1978-435, Filed November 1, 1978. is modified by. IRC §453B(a);.

Comm. Phillips (4 Cir; 1960), 275 F.2nd 33,5 AFTR 2d 855. Reg. §25.2512-6(a), Example 3. Reg. §25.2512-6(a);. Ltr.

7928014. Friedman v.

Comm., 41 T.C. 428 (1963), aff'd 346 F.2d 506 (6th Cir. 1965). IRC §170(e); Reg. §1.170A-4(a)(1). Reg.

§1.170A-4(a)(3). IRC §72(e)(4)(C). Reg. §1.170A-4(a)(3). Reg. §1.83-7(a).

Reg. §1.83-7. IRC §83(b). Reg. §1.83-7. Reg. §1.83-2(b).

Installment Sale Of Intangible Property

Reg. §1.83-2(c). Reg. §1.83-7. See, and for an in-depth analysis on the gift tax consequences and valuation methods when transferring a stock option. IRC §421.

It should be noted that the Alternate Minimum Tax of Section 56 can impose significant taxes on an employee who exercises an ISO. §1.421-7(b); IRC §§422(b)(6); 423(b)(9). Reg. §1.425-1(c). Reg. 1.421-7(b)(2). Reg.

Installment Sale Of Intangible Property

7701(a)(1). The trust, however, will not pay any tax unless it has unrelated business taxable income.;;.; See also.